EG Bank has announced its collaboration with Mastercard to enhance accessibility to financial services, expand the use of digital payments, and attract a new segment of affluent clients to its card portfolio. This reflects the bank’s commitment to supporting its strategy of providing a seamless, secure, and convenient payment experience for users.

As part of this partnership, Mastercard will support EG Bank in developing its card offerings, including debit, credit, and commercial cards. It will also provide customized financial solutions and introduce new benefits aimed at enhancing the experience of Mastercard cardholders.

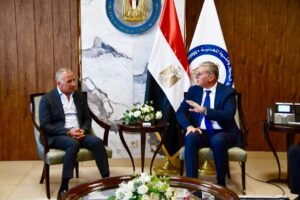

Commenting on the collaboration, Yasmine Galal, Head of Retail Banking Services for Individuals and SMEs at EG Bank, said:

“Our partnership with Mastercard is a significant milestone in our strategy to diversify our products and enhance our customer experience.

By leveraging advanced payment solutions, we aim to strengthen our portfolio and broaden our reach to new customer segments.

This collaboration allows us to deliver smooth and rewarding financial solutions that meet the evolving needs of our clients, while also driving long-term growth and innovation in Egypt’s financial sector.”

In this context, Mohamed Assem, Country Manager for Mastercard in Egypt, Iraq, and Lebanon, stated:

“We are pleased to collaborate with EG Bank to support the development of its card portfolio and reinforce its expansion strategy.

This partnership reflects our shared commitment to advancing digital payment growth and unlocking new opportunities for sustainable financial empowerment.”

Through the expansion of its services, EG Bank seeks to reach new customer segments. The bank offers a wide range of banking services for individuals, businesses, and institutions, in addition to a suite of digital solutions such as mobile and online banking. These solutions enable customers to manage their accounts and conduct transactions remotely with ease.