DisrupTech Ventures, one of Egypt’s leading venture capital funds specializing in supporting fintech startups, announced its first investment outside of Egypt in Africa. This investment is part of the company’s Pre-Series A funding round.

Lagos-based Winich Farms is addressing key challenges in Nigeria’s agricultural sector: fragmented supply chains and weak financial inclusion.

Although agriculture accounts for 21% of Nigeria’s GDP and provides employment for millions of people, smallholder farmers—who comprise 80% of the agricultural workforce and produce 90% of total output—remain largely excluded from modern supply chains and formal financial systems.

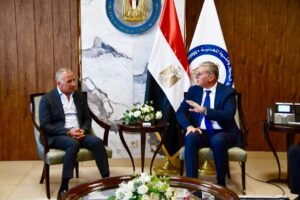

Commenting on this first international investment, Mohamed Okasha, Co-Founder of DisrupTech Ventures, said:

“Our investment in Winich reflects our strong belief in the growth opportunities in Nigeria’s agritech and fintech sector, and the scalability of their business model. Winich not only solves real problems facing smallholder farmers, but does so with a replicable and scalable model. Agriculture is also a cornerstone of the Egyptian economy, and we look forward to sharing expertise and best practices between the two markets as Winich expands across the continent.”

Atay Riches, CEO and Co-Founder of Winich Farms, said:

“We are excited to have DisrupTech Ventures join us in this new phase of growth. Their expertise in growing fintech startups will be invaluable as we strengthen our operations, empower more farmers, and expand into new markets within and beyond Africa. This partnership supports our vision of building a more efficient and inclusive agricultural supply chain, starting in Nigeria and extending to global markets.”

Amidst the challenging economic conditions in Nigeria, including rising agricultural input prices and increased interest rates due to the depreciation of the naira, Winich offers a timely and effective solution that addresses two of the sector’s biggest challenges: market access and access to finance.

Currently operating in 29 of Nigeria’s 36 states, Winich plays a pivotal role in connecting smallholder farmers to larger agricultural value chains. Its digital platform directly connects over 180,000 farmers to buyers such as processors and retailers, eliminating the middlemen that squeeze farmers’ profit margins. Through a nationwide network of agent-managed collection points, Winich efficiently manages collection and logistics operations without owning physical assets.

Winich Cards also offers digital solutions that reduce reliance on cash payments and build a digital ledger that later helps farmers qualify for financing. Additionally, the company provides direct financing and agricultural support services in partnership with the Kebbi Agricultural Research Development Agency (KARDA) to help farmers expand their production and improve efficiency.

Looking to the future, Winich plans to leverage its success in Nigeria to expand into new African markets and explore export partnerships across the Middle East and North Africa. With the growing demand for reliable, traceable, and technology-enabled agricultural supply chains, Winich is well positioned to become a continental leader in post-harvest agricultural and fintech solutions.

DisrupTech Invests in Winich Farms to Support Agricultural and Financial Innovation in Nigeria

DisrupTech Ventures, one of Egypt’s leading venture capital funds specializing in fintech startups, has announced its first investment outside of Africa, supporting Winich Farms, a fast-growing Nigerian agritech company that empowers smallholder farmers with access to markets and finance across Nigeria. This investment is part of the company’s Pre-Series A funding round.

Lagos-based Winich is working to address key challenges in the Nigerian agricultural sector: fragmented supply chains and weak financial inclusion.

Although agriculture accounts for 21% of Nigeria’s GDP and provides employment for millions of people, smallholder farmers—who comprise 80% of the agricultural workforce and produce 90% of total output—remain largely excluded from modern supply chains and formal financial systems.

Commenting on this first international investment, Mohamed Okasha, Founding Partner at DisrupTech Ventures, said:

“Our investment in Winich reflects our strong belief in the growth opportunities in Nigeria’s agtech and fintech sector, and the scalability of their business model. Winich not only solves real problems facing smallholder farmers, but does so with a replicable and scalable model. Agriculture is also a cornerstone of the Egyptian economy, and we look forward to sharing expertise and best practices between the two markets as Winich expands across the continent.” For his part, Atay Riches, CEO and co-founder of Winich Farms, said: “We are excited to have DisrupTech Ventures join us in this new phase of growth. Their experience in developing fintech startups will be invaluable as we strengthen our operations, empower more farmers, and expand into new markets within and beyond Africa. This partnership supports our vision of building a more efficient and inclusive agricultural supply chain that starts in Nigeria and extends to global markets.”

Amidst the challenging economic conditions in Nigeria, including rising agricultural input prices