Ashraf El-Kady, Chairman of the United Bank, revealed that the mortgage finance portfolio dedicated to low- and middle-income housing exceeded EGP 3.2 billion by the end of May 2025, with a total of 16,500 clients across various governorates in Egypt.

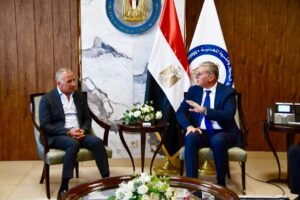

This announcement came on the sidelines of the United Bank’s sponsorship of the fifth edition of the Akhbar Al-Youm Real Estate Conference, held today in Cairo under the patronage of Prime Minister Dr. Mostafa Madbouly.

El-Kady pointed out that the United Bank has become the seventh-largest financier of low- and middle-income housing in the Egyptian market, according to a report by the Social Housing and Mortgage Finance Support Fund. This reflects the bank’s commitment to supporting the state and the Central Bank of Egypt’s efforts in achieving social justice and reducing informal settlements.

He explained that the expansion of mortgage financing services represents one of the effective tools to stimulate the real estate market and meet the growing demand for housing units, especially in the low- and middle-income segments, thereby directly contributing to economic growth.

He added that the United Bank provides mortgage finance services in 28 governorates, with a special focus on Upper Egypt, as well as the Canal and Delta regions. The bank’s activities also extend to financing luxury housing units, in response to the diverse needs of its client base.

El-Kady affirmed that digital transformation is at the forefront of the United Bank’s priorities. The bank’s mortgage financing system relies on integrated digital solutions that operate around the clock, facilitating installment payments through a wide network of over 225 ATMs and 68 branches across the country. Customers can also transfer salaries or switch from other banks with ease, without needing to visit branches in person.

He concluded by emphasizing that the United Bank’s strong technological infrastructure has enabled it to deliver services across the country—even in areas without direct branch presence—enhancing its ability to reach broader segments of the population and support the state’s efforts in providing suitable housing for all.